Clients

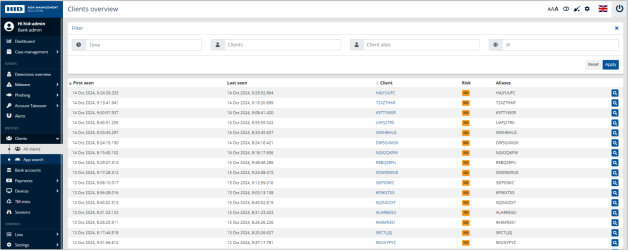

Overview

Bank client register. Clients can be sorted by their Login and Risk score. It is possible to search the user by Login (User ID), bank accounts, or IP address.

Magnifying glass takes you to the User detail page.

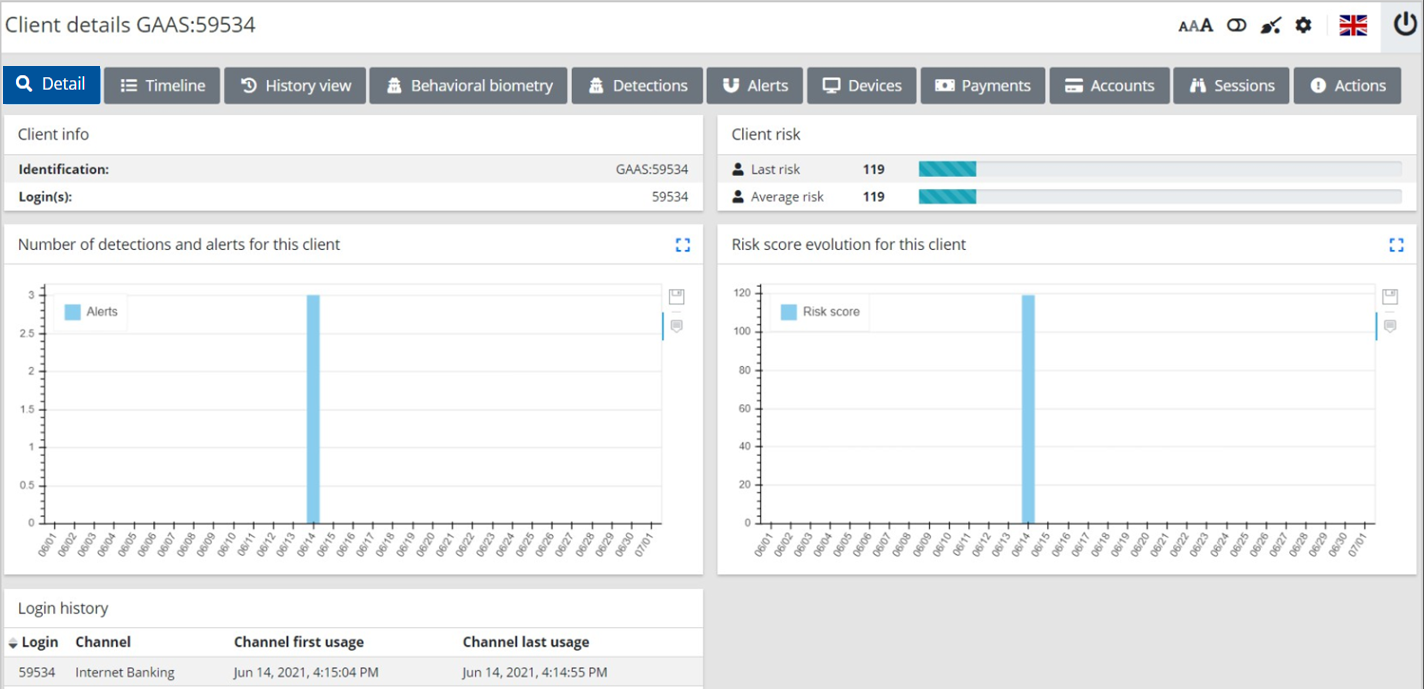

User details

At the top of the screen, besides the user’s Risk score, there are two graphs - Number of detections and alerts of this client (from the first login) and Evolution of risk score of this client (client’s risk development compared to the average risk of other clients).

The tabs at the top of the page provide a wide variety of information helping the fraud analysts to understand the user’s behavior, habits, facts about his bank account, and all necessary contexts that might be essential for fraud analysts’ decision-making process. These tabs are further described below.

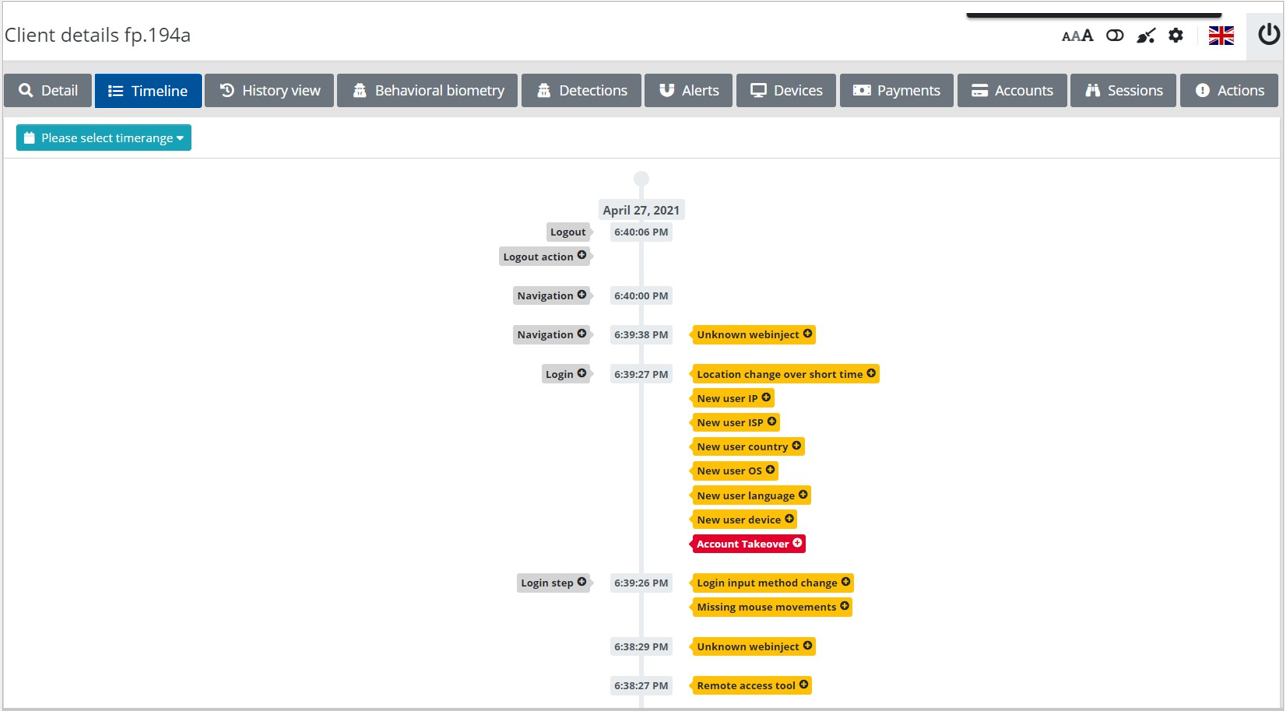

Timeline

The Timeline shows the user’s actions, payments, and related triggered alerts and detections.

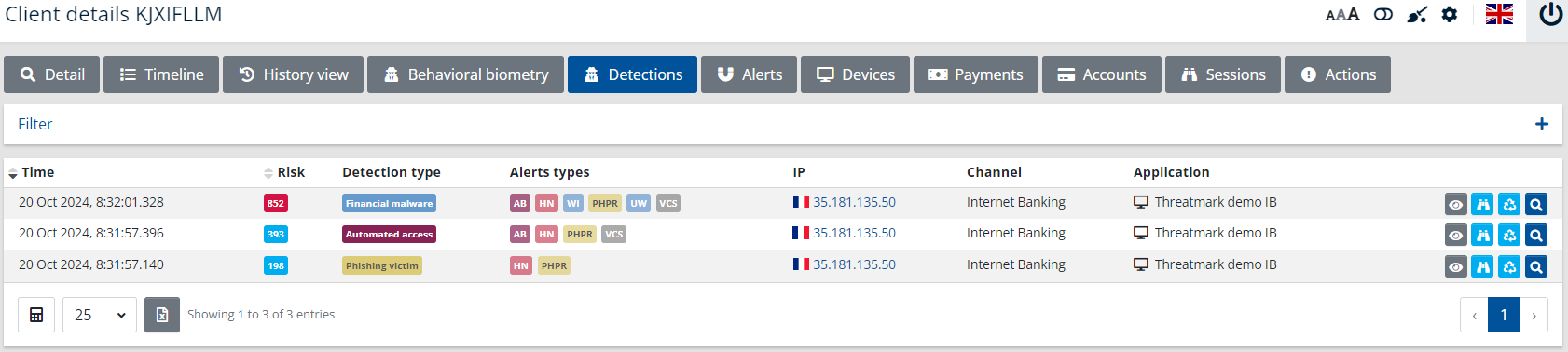

Detection

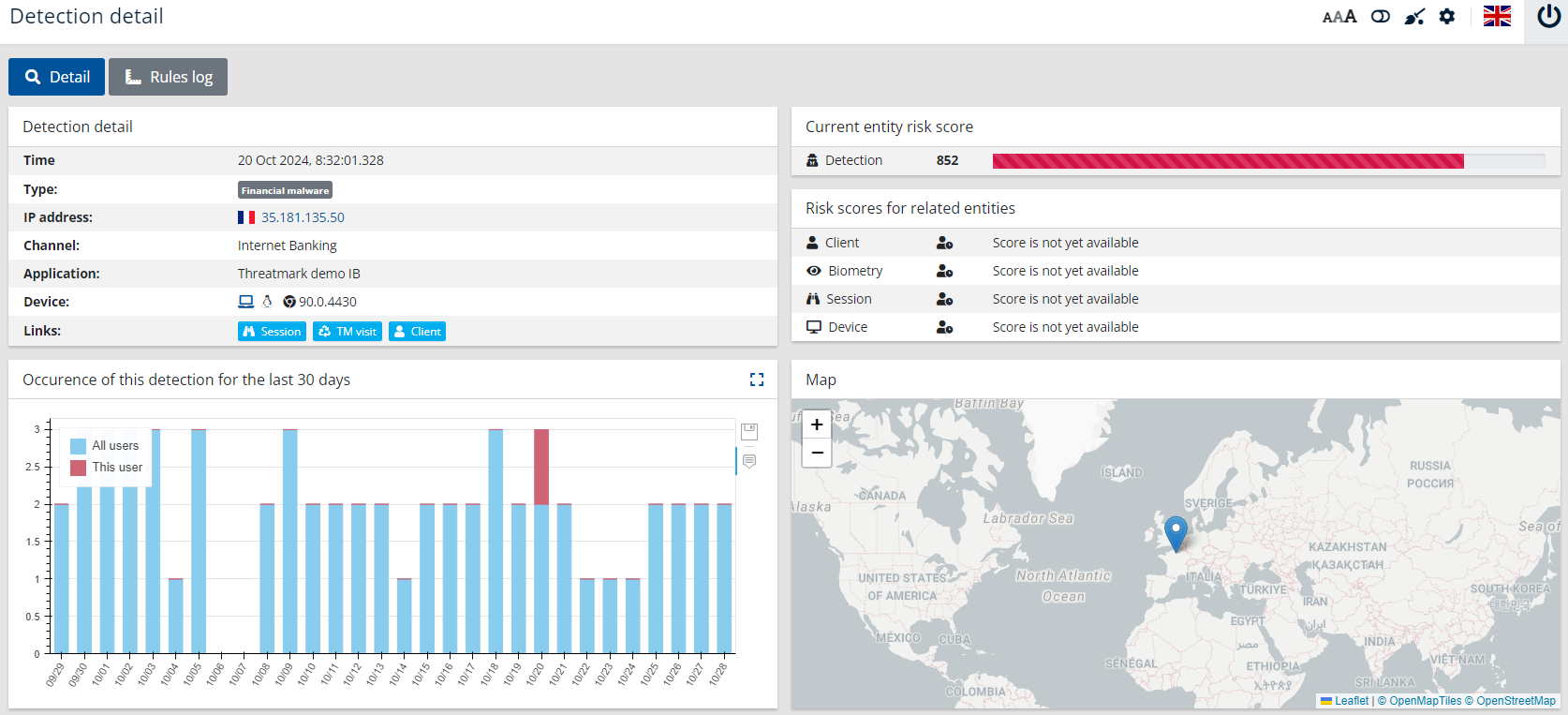

List of detections created for the specific client. Detections can be sorted by Time and Risk score. Magnifying glasses take you to Session detail, TM visit detail, and the Detection detail page. At the bottom left corner, there is a button for exporting data to .xlsx.

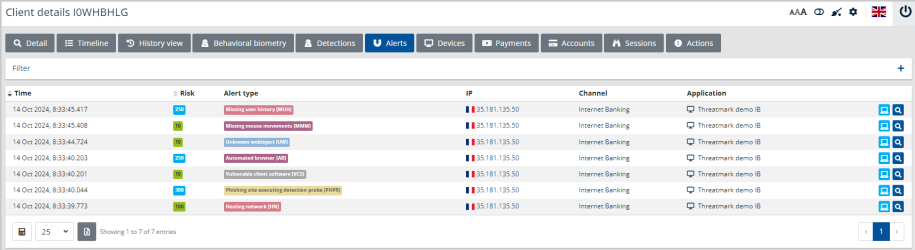

Alerts

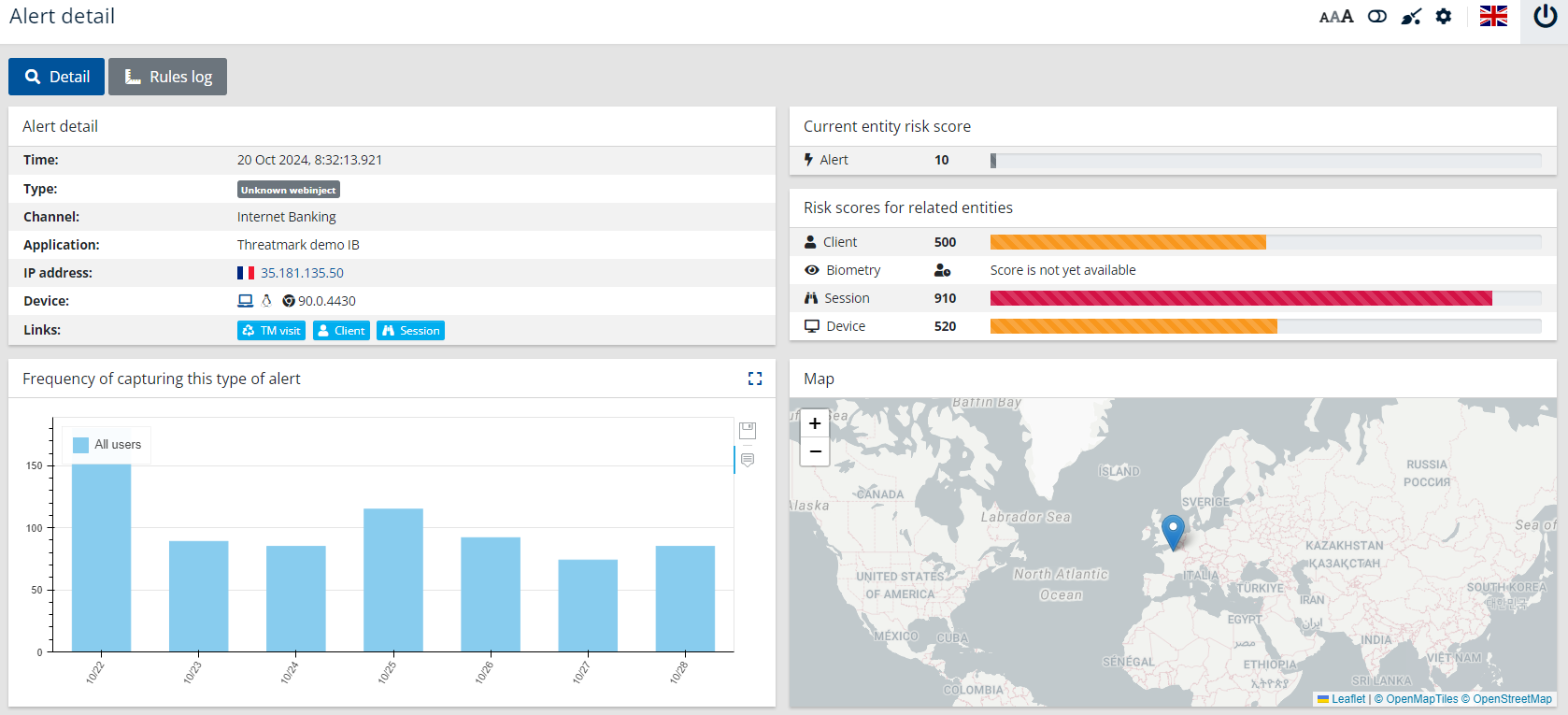

List of signals triggered for specific users. Magnifying glasses take you to Session detail, TM visit detail, and the Signal detail page.

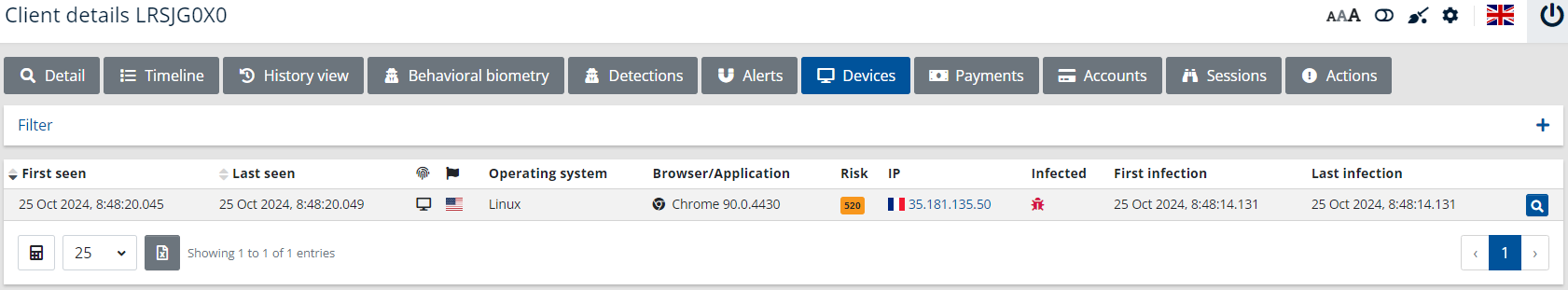

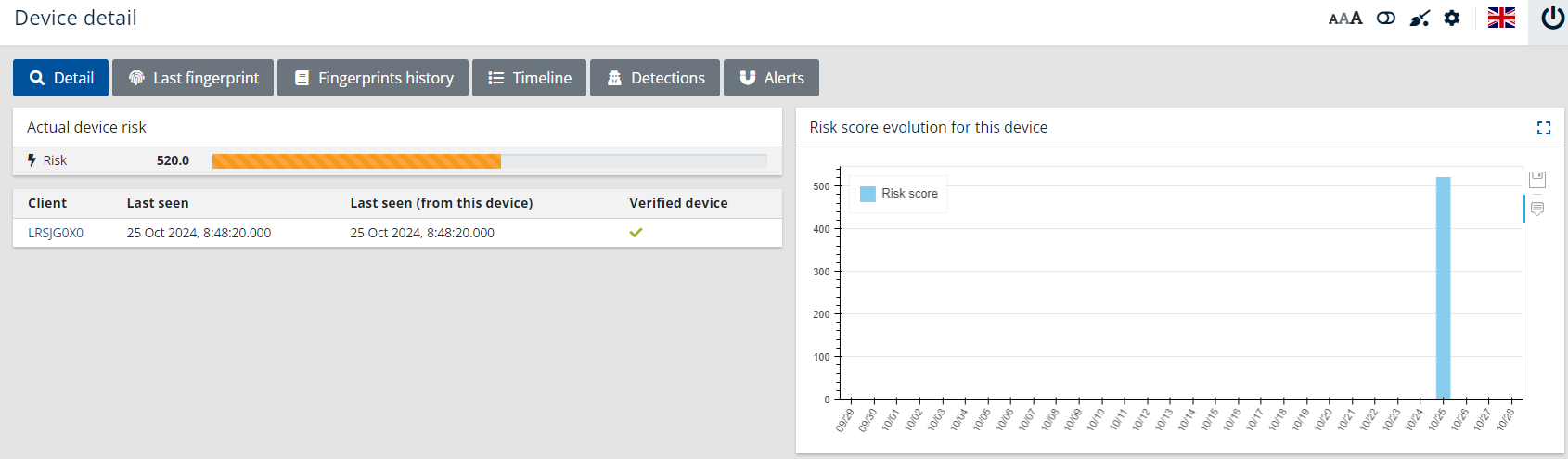

Devices

Hovering over the flag in the Language column shows the country name, clicking the IP takes you to the IP detail page, the magnifying glass takes you to the Device detail page.

Payments

Only in solution with Payments

Payments can be sorted by Time, Risk, and Amount. Interesting info on this page is the payment status, Open/Accepted/Denied.

Magnifying glasses take you to Session detail, TM visit detail, and the Payment detail. Clicking any bank account takes you to the Bank account details page.

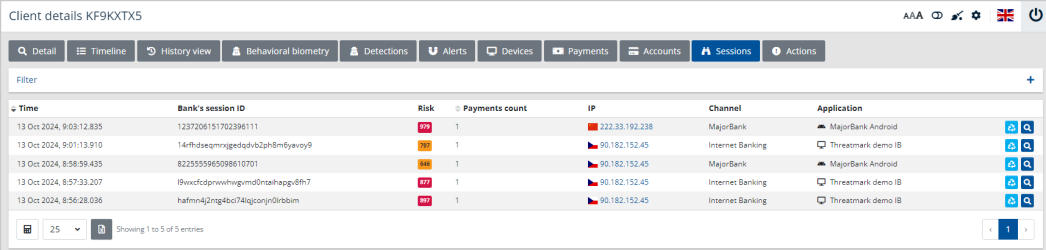

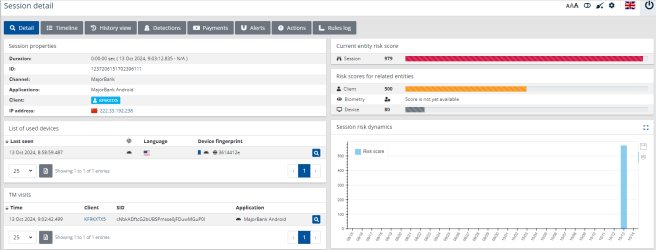

Sessions

List of all sessions HID RMS system logged for the specific client. Session ID (SID) is provided.

Sessions can be sorted by Time, Risk and amount of Payments the user made. Magnifying glass takes you to Session detail; User ID and IP to its details.

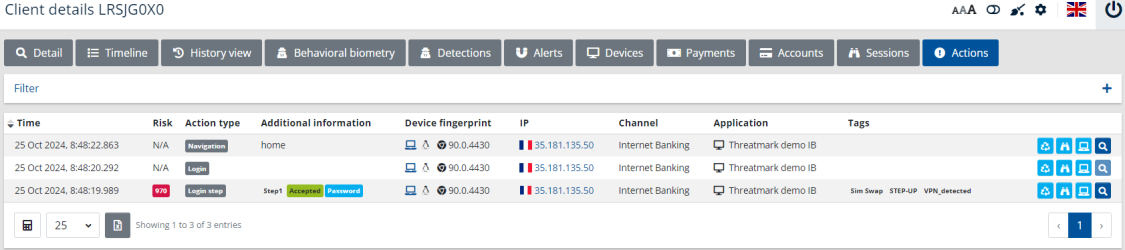

Actions

The action history of the specific user can be sorted by time.

Left-click:

-

Magnifying glass for Session and TM visit

-

Operating system info icon to show/hide tooltips

-

IP address to get to IP detail page or Payment create detail

-

Magnifying glass in the Detail column to get to the Action detail page

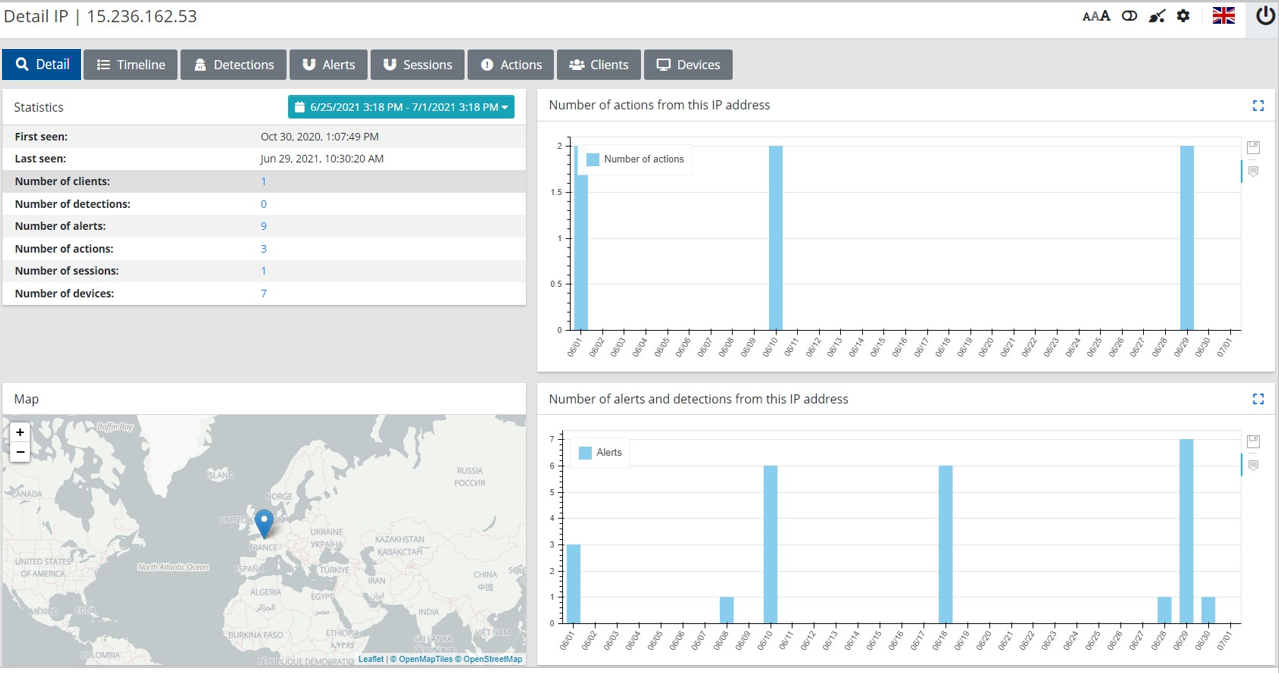

IP detail

IP detail doesn’t have a direct link in the main navigation panel. It is, however, important to mention this among entities as many of them refer to IP detail.

There are many ways how to get to the IP detail page, e.g., from the Detections overview, Detection detail, Client detail, Devices, etc.

IP detail has information-rich tabs, similarly to the User detail page.

IP detail provides a detailed overview of what is happening on a specific IP, how users on the IP behave, what actions they take, what devices they use. Having a closer look at the IP where multiple detections were created can reveal a suspicious/fraudulent IP (potentially used by a group of fraudsters for taking over clients’ accounts, unauthorized third-party applications accessing clients’ accounts, etc.)