Payments

Overview

The payments page is an overview of all payments done in the protected application(s). Incoming payments can only be seen within the same bank. Outgoing payments, in turn, can be seen to any account number (different bank, different country).

When scoring the riskiness of payment the HID RMS system takes the following into consideration:

-

The history of sending similar payments, specifically

-

the usual payment amount

-

the time at which the client usually makes payments

-

-

The payment amount

-

The reputation of the beneficiary account

Repetitive payments generally yield a low score.

Payments can have 3 different statuses:

-

Open: the payment is created and waiting to be signed

-

Accepted: the payment is already signed and accepted to be processed

-

Rejected: the payment wasn't signed and wasn't accepted to be processed

Payment filtering by amount is done by the base amount value, which is dependent on individual implementations (e.g. for Europe it most probably be Euro). This base amount shares the currency with all other payments in the bank and thus can be easily applied to filter payments made in different actual currencies.

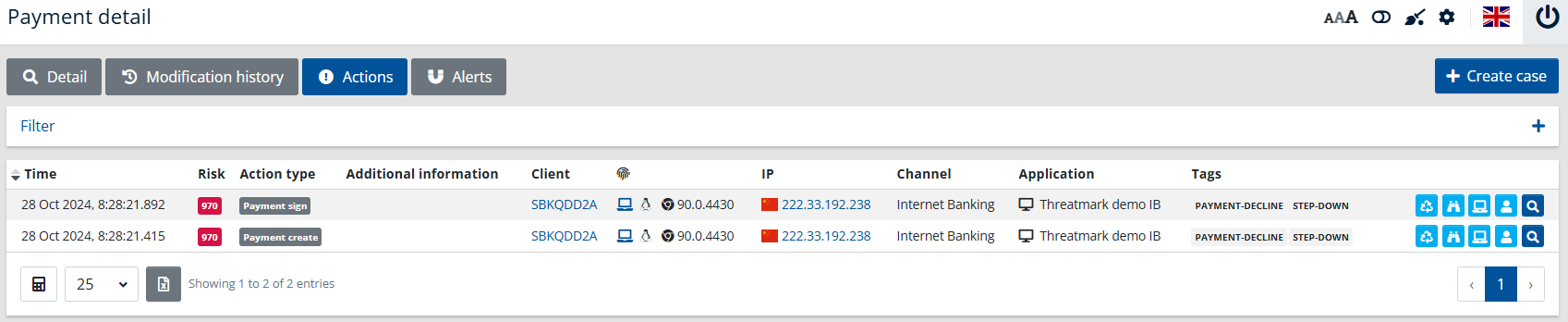

Payment detail

The payment detail view shows an overview of the details associated with the payment.

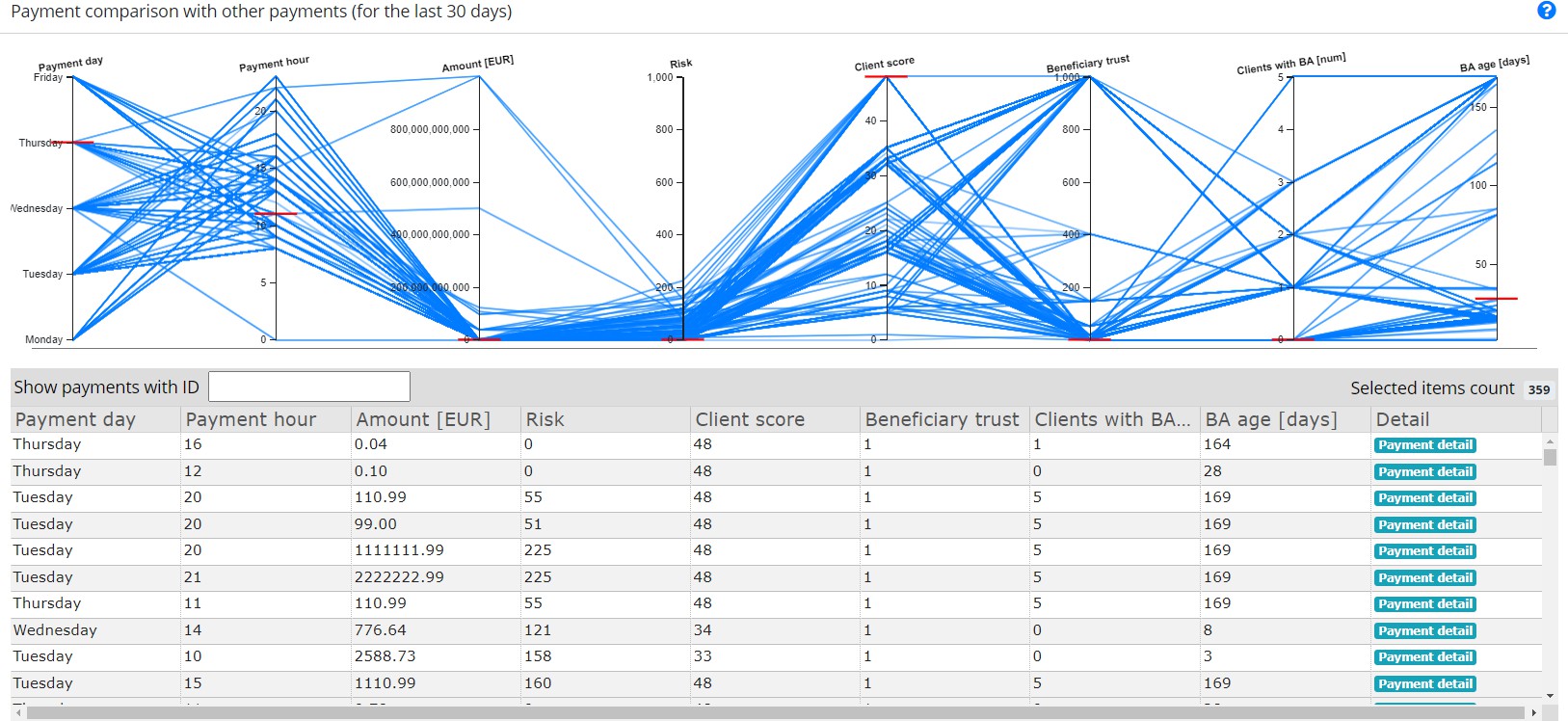

The detail view also contains a widget called Payments comparison represented by parallel coordinates graph and connected to this graph table of related payments. This widget shows how the selected payment compares to other payments made by the same client within the last 30 days.

Every blue line on the graph represents related payment; red short horizontal lines on each axis represent the current payment value for a specified dimension.

Graph visualize the next payment properties:

-

Amount: payment amount in the base currency for the current HID RMS deployment

-

Beneficiary account age: age of the beneficiary account, if this account is within the same bank

-

Beneficiary trust: trust of the beneficiary account; the higher the value - the higher the trust. If the value is close to 1000 - the account can be considered safe

-

Client anomaly score: risk score for the client that sent the payment

-

Clients with the beneficiary account: number of clients who have sent payments to that beneficiary account in the past

-

Payment time: the time-buckets when payment was executed (hour of a day, day of a week)

-

Risk: risk score for current payment

The widget is highly interactive and allows the following:

-

Reposition any axis for better visualization and comparison.

-

Select a subset of data on any axis by dragging the mouse along the line. This will limit the shown data to the subset that you selected. To remove selection on a specific axis just click on the same axis with the left mouse button on the unselected region.

-

Double-click on the title of a to sort the corresponding data in descending/ascending order.

-

Searching for specific payment via Payment ID. It can be combined with visual data selection on the graph.

Modification History Tab

Payment usually goes via several states until its final resolution. HID RMS processes every payment status as a separate version of the payment and tracks every modification/editing done for a specific payment state. Those states then can be compared with each other for deeper investigation.

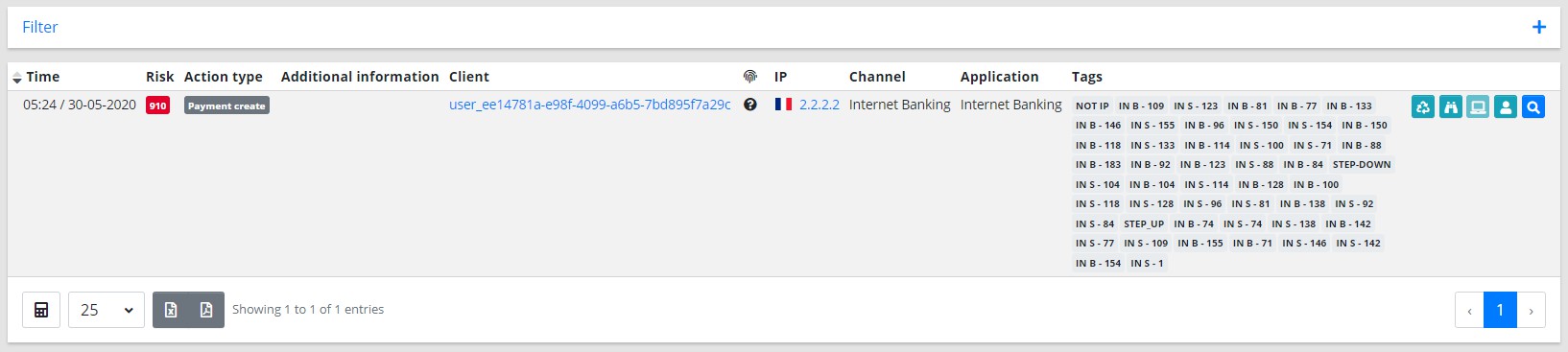

Actions Tab

An overview of actions taken by the client during the session containing the payment. The magnifying glass icon takes you to the corresponding action's detail view.

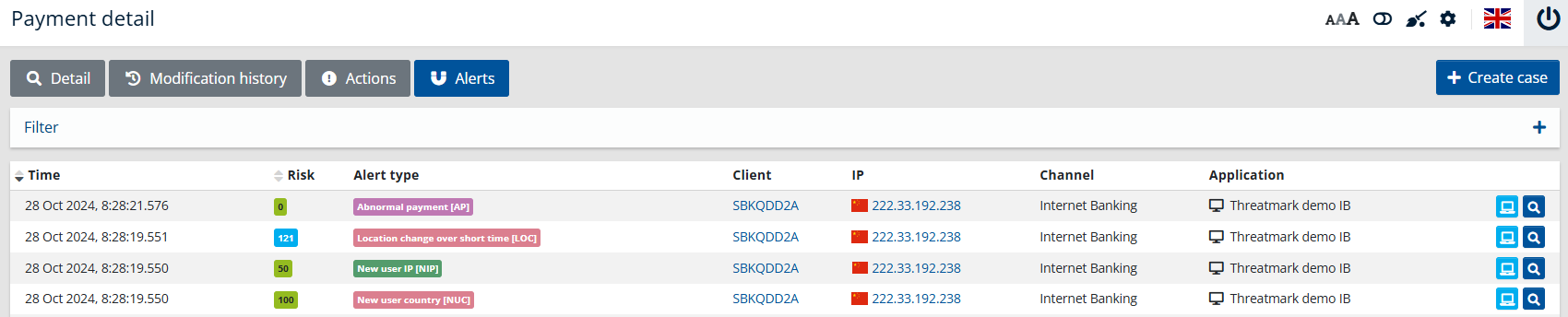

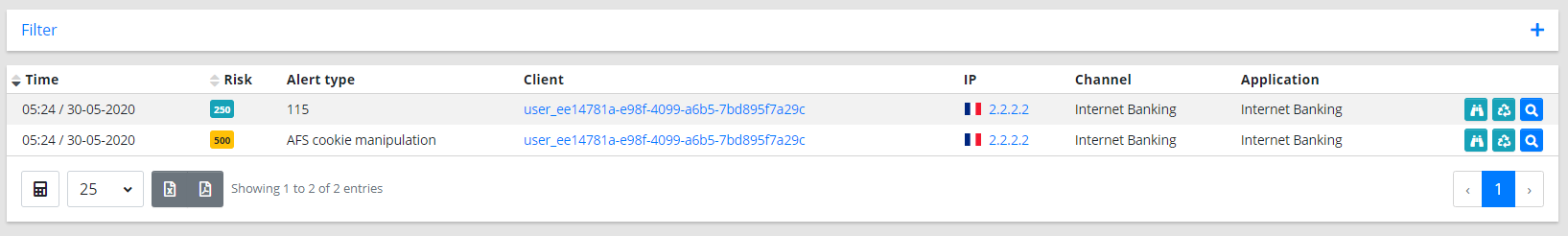

Alerts Tab

An overview of alerts triggered during the session containing the payment. The magnifying glass icon takes you to the corresponding alert's detail view.

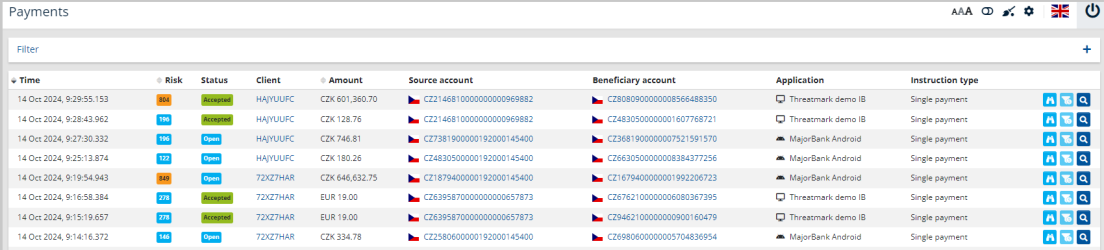

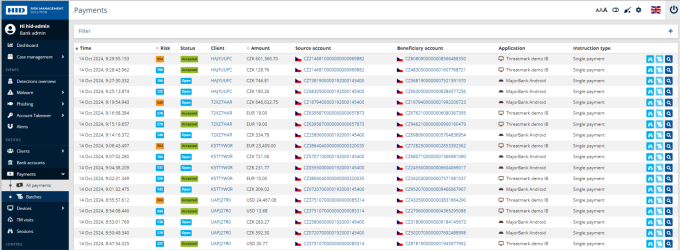

All payments

Within the Payments tab, you can filter individual payments or groups of payments based on the filter parameters such as Time, Risk, Amount, Source account, Beneficiary account, application, Express payment, Foreign payment, Currency, Status, and Batch ID.

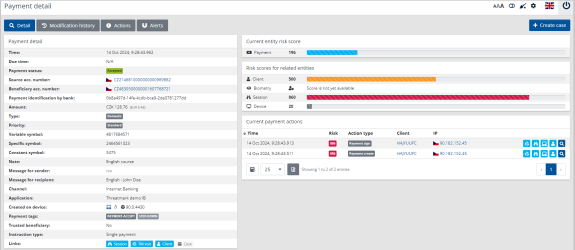

Payment detail

Various infoboxes are available:

-

Payment detail - Most important information in this section are Date, Payment status, Payer and Beneficiary, Amount of the payment, type, and others.

-

Current entity risk score

-

Risk score for related entities: Risk separately for Client, Biometry, Session, and Device Client, Biometry, Session, Device entity. For more details please see a separate section in this documentation.

-

Current payment actions - Individual current payment steps with the risk score and buttons to various views.

-

Payment comparison with other payments (for the last 30 days)

History of actions related to a specific payment

This section shows the action history related to payments made by a specific user. The magnifying glass takes you to the Action details.

History of alerts related to a specific payment

This section shows the alerts triggered during the session with the payment. The magnifying glass takes you to the Alert detail.